cash app venmo tax

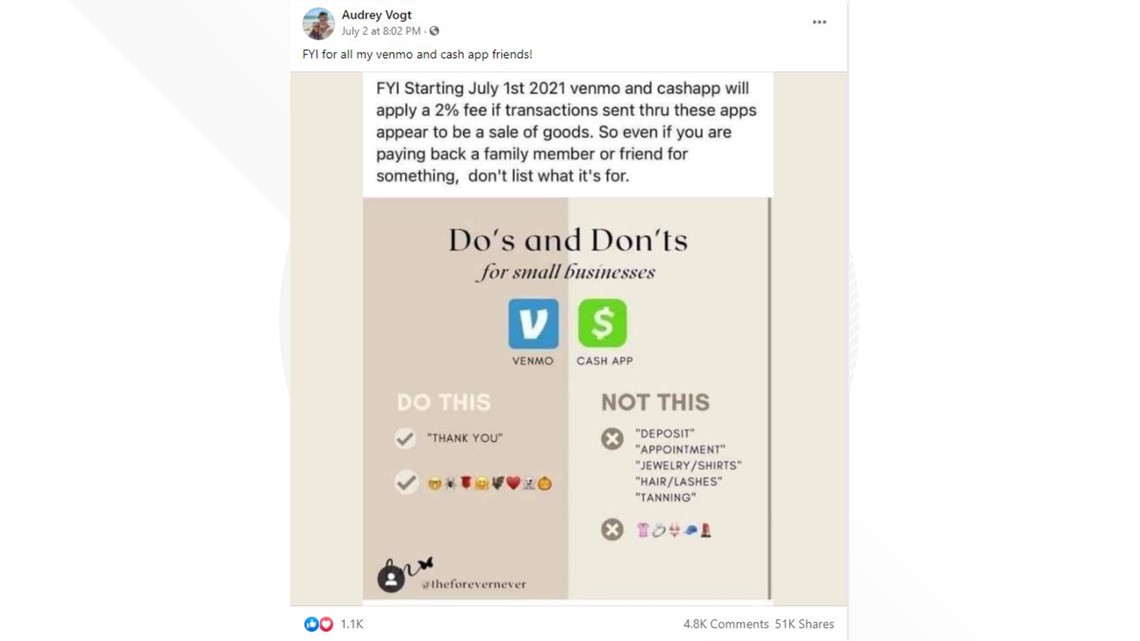

But users were largely mistaken to believe the change applied to them. As of Jan.

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

Why things changed The changes to tax laws affecting cash apps were passed.

. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal. Squares Cash App includes a partially updated page for users. Here are some details on what Venmo Cash App and other payment app users need to know.

1 the reporting threshold for business transactions processed through any cash apps is 600. With the Venmo Credit Card¹ you can earn up to 3 cash back² to send spend or even to auto-purchase the crypto of your choice from your Venmo account³ Reward categories. Youll Owe Taxes on Money Earned Through PayPal Cash App and Venmo This Year.

At this time Zelle. PayPal and Venmo TaxesTax Rules for Cash Apps and 1099-K Form Explained. This new rule applies to paying cash app taxes including on income received through PayPal Venmo Cash App and most third-party payment networks.

A Venmo agent will never ask you for this code under any circumstances. Cash App Taxes - 100 Free Tax Filing for Federal State Tax filing made fast easy and 100 free Estimate your refund File now Loved by Millions Over 38 million returns rated 48 out of 5. Fact or Fiction.

Cash App Speed up your direct deposits With a Cash App account you can receive paychecks up to 2 days early. If you make more than 600 through digital payment apps in 2022 it will be. Social media posts like this tweet that was published on September 15 have claimed that starting January 2022 if you receive more than 600 per year through third-party.

The change in tax law put into effect by the American Rescue Plan during the Covid requires your gross income to be reported to the IRS if it totals more than 600. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions. An FAQ from the IRS is available here.

Get 3 free ATM withdrawals per month when you have at least 300 coming in. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue. The P2P peer-to-peer payment apps have soared in popularity in recent years.

Many TPSOs such as PayPal and Venmo and others like Cash App have separate accounts that allow users to identify which of their transactions are for goods and. Venmo will never ask you to install a third-party app. PayPal which owns Venmo is offering similar guidance for users of its app a company spokesperson said.

Venmo will never ask to access your device remotely. New Cash App Tax Reporting for Payments 600 or more Under the prior law the IRS required payment card and third party networks to issue Form 1099-K to report certain payment transactions.

Federal Government To Ask For Taxes On App Transactions Over 600

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

Getting Paid On Venmo Or Cash App There S A Tax For That The Jerusalem Post

What Is Cash App Pros Cons Features Nextadvisor With Time

Venmo Will Have New Service Fees But You Have To Opt In Verifythis Com

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

What Information Does The Irs Collect From Taxpayers On Venmo Paypal Fox Business

Eyewitness News On Twitter Heads Up If You Use Payment Apps Like Venmo Paypal Or Cashapp The New Year Ushered In A Change To An Irs Tax Reporting Rule That Could

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

Nowthis If You Are Doing Business With Your Clients Using Third Party Apps Like Cash App Paypal Venmo Or Zelle You Should Know That The Irs Will Soon Require Businesses To Report

New Tax Code Rules In 2022 Eyewitness News

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas

Fact Or Fiction You Ll Owe Taxes On Money Earned Through Paypal Cash App And Venmo This Year Cnet

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

New Irs Rule Requires Paypal Cashapp To Report Payments Over 600

Cash App Won T Have New Taxes In 2022 Despite Claims

New Tax Rule Regarding Business Transactions On Payment Apps Abc Columbia